irs child tax credit tool

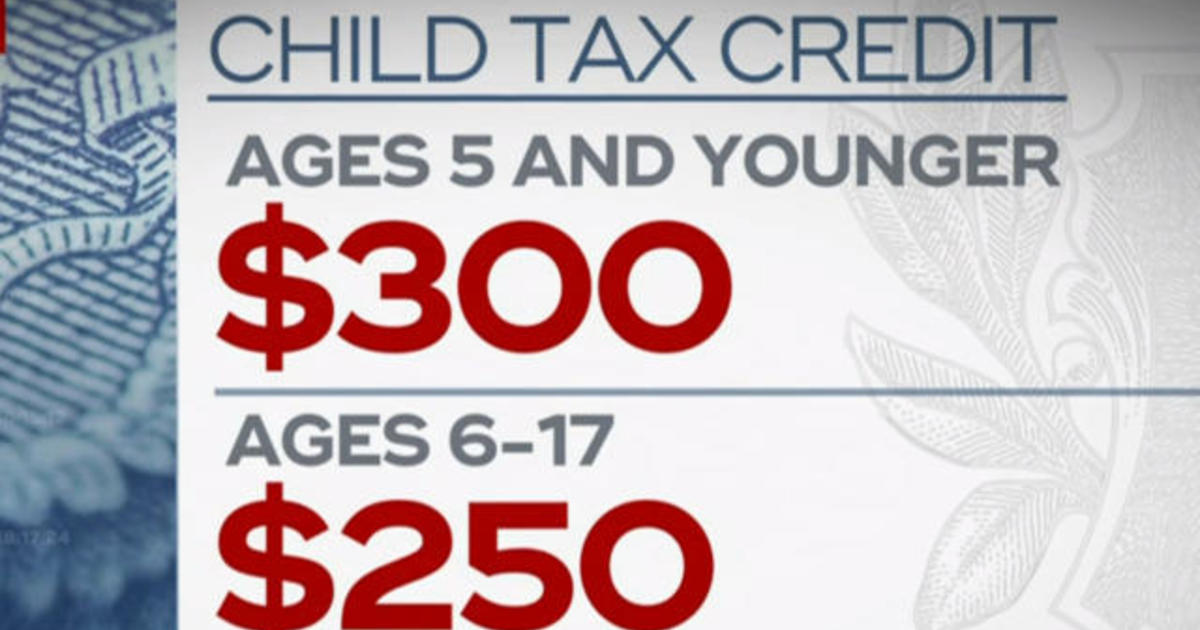

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6. Qualifying families will get advanced payments.

Crosslink Professional Tax Solutions The Irs Has Released Their New Online Tool For Those Families Choosing To Opt Out Of The Monthly Advance Payments For The Child Tax Credit Learn More

IRS-approved official E-file provider.

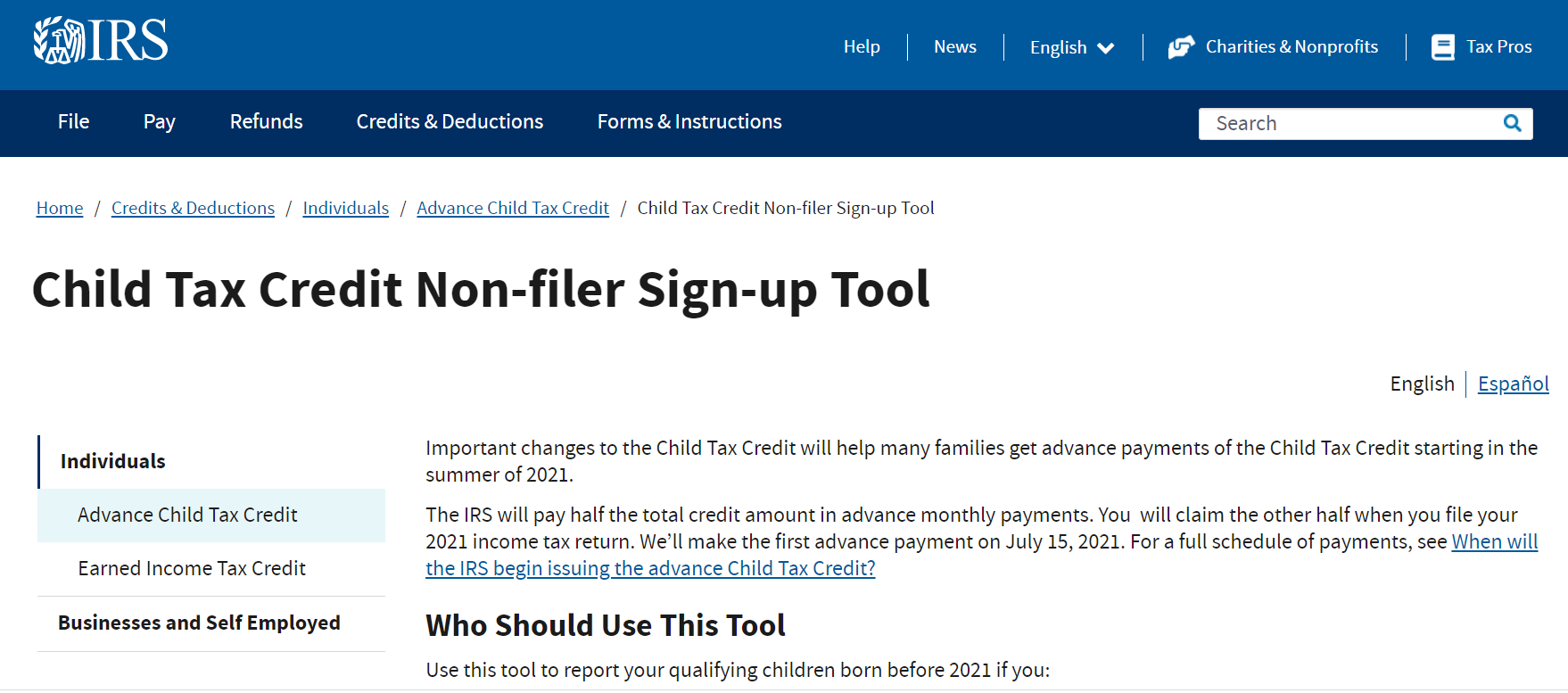

. The Internal Revenue Service created a tool to ensure families that havent filed a 2020 tax return get the child tax credit. This new tool is accessible just on IRSgov. The payments will be up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 through 17.

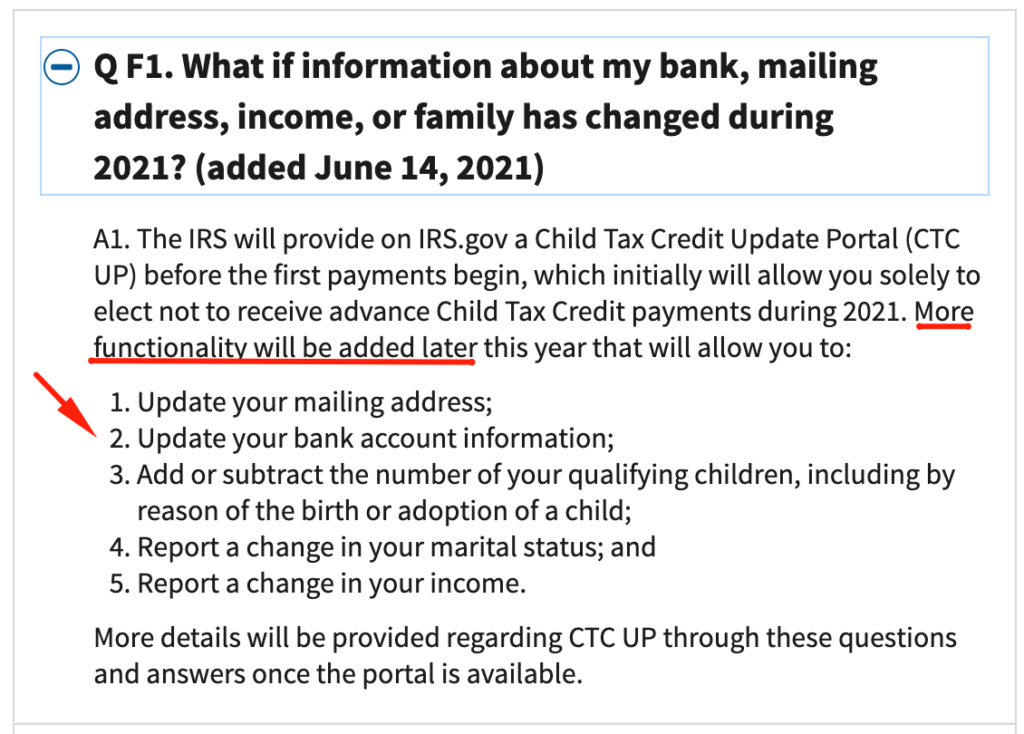

Families who guarantee the Child Tax Credit for 2021 will get up to 3000 per qualifying child who is somewhere in the range of 6 and 17 years of. The IRS urges families to use a special online tool available only on IRSgov to help them determine whether they qualify for the child tax credit and the special monthly advance. The White House has put a temporary pause on the IRS Child Tax Credit tool Politico reported on March.

That amounts to 300 per month. The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July. For others who have yet to receive the monthly child tax credit payments you can use the tool if you meet the following criteria.

Parents can now check their eligibility for the expanded child tax credit and manage their payments which begin next month using two online tools the Internal Revenue. The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers who didnt qualify. The childs age must be under 6 or 17 and.

Calculate how much you will get from the expanded child tax credit This week the IRS launched an updated version of the online non-filer tool it used last year to help people. Half will come as six monthly payments and half as a 2021 tax credit. Eligible parents will begin receiving the first monthly installment of the new enhanced child tax credit starting on July 15.

You have a valid Social Security number You. The IRS will pay 3600 per child to parents of children up to age five. The payments which could total as much as.

Standard child tax credit The Martins would receive a check for some of the child tax credit left after paying taxes but lose 1300 that could be used only to pay income tax. Similar to certain other credits with an advance payment option taxpayers who receive. Year 2021 -CTC Refund Rules.

If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you can use the Code for America. You get to claim the lesser of 15 of your earned income above 2500 or your unused Child Tax Credit amount up to 1400 per qualifying child. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

Use our simplified tax filing tool to claim your Child Tax Credit Earned Income Tax Credit and any missing amount of your third stimulus payment. The IRS is no longer allowing people to use its Child Tax Credit tool.

Irs Launches Child Tax Credit Eligibility And Update Tools

Irs Tool Helps Low Income Families Register For Monthly Child Tax Credit Payments Tax Pro Center Intuit

Irs On Father S Day The Irs Wants Eligible Families Who Did Not File Taxes For 2019 Or 2020 And Didn T Use The Irs Non Filers Tool For Economic Impact Payments To Know

Child Tax Credit You Can Finally Update Your Income Online Money

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Two New Child Tax Credit Tools Launched By Irs More Features Are Coming The Agency Says Nj Com

Irs Issues Child Tax Credit Faqs And Online Non Filer Tool

Irs Announces Spanish Language Child Tax Credit Assistant Tool Taxing Subjects

Irs Online Tool Helps Families Determine If They Qualify For The Child Tax Credit Kenilworth Nj News Tapinto

Child Tax Credit Update How To Change Your Bank Info Online Money

How To Fill Out The Irs Non Filer Form Get It Back

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

How You Can Claim Your Child Tax Credit Money Using Irs New Tracking Tool The Us Sun

Irs Tool For Child Tax Credit Link And How To Use It As Usa

New Child Tax Credit Tool Released By Irs To Help People Get Their Monthly Payments Nj Com

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Irs Launches 2 New Online Tools To Help Families Claim Boosted Child Tax Credit Fox Business

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca

Tools To Unenroll Add Children Check Eligibility Child Tax Credit